A closer look at 3 new tender offer funds

The unlisted closed end fund sector continues to grow. So far in 2020, nine new tender offer funds have filed initial registration statements. These new funds encompass a wide variety of strategies, and a wide range of fund sponsors. Our fund launches page contains a downloadable list of new tender offer funds. This article highlights three funds that filed registration statements in July.

CPG Cooper Square International Equity

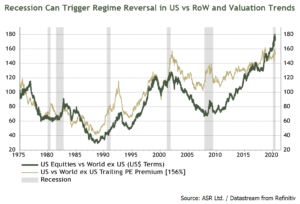

Central Park Group is adding another tender offer fund to its lineup with the registration of CPG Cooper Square International Equity, LLC on July 17. This fund will implement a long/short equity strategy focused on stocks outside the US. This strategy is interesting and possibly timely, when one considers how over- allocated most investors are to US stocks. A major regime shift in global equities, which is long overdue, will be highly beneficial for this fund. John Authers at Bloomberg recently highlighted how regime shifts often follow major crises(like Covid-19):

Central Park Group is serving as the adviser. Select Equity Group will serve as the sub-adviser. The fund is offering two share classes- Class A and Class I. Class A will have up to a 3.0% sales load, while Class I will have no sales load. Management and incentive fee structure is 1.5% /20%. Its a public offering, so the prospectus is still pending SEC approval.

In addition to CPG Cooper Square International Equity, Central Park Group currently has 6 other active tender offer funds.

NB Crossroads Private Markets Access Fund

Neuberger Berman is adding yet another tender offer fund to its Crossroads Platform. It filed registration statement the NB Crossroads Private Markets Access Fund on July 17. Like Neuberger Berman’s other tender offer funds, the new fund will invest in a variety of private equity vehicles managed by other managers. Its offering two share classes: Class A and Institutional Class. The Class A will have a sales charge, although its still unspecified in the draft prospectus. Unlike prior funds from Neuberger Berman on the Crossroads platform, this one doesn’t appear to be using a master/feeder structure, although that could change with subsequent amendments. The advisory fee and incentive fee are also unspecified in the draft prospectus. NB Crossroads Private Markets Access Fund is a public offering, so the prospectus is still pending SEC approval.

Neuberger Berman has three other tender offer funds in the market, which together have an additional seven feeder funds.

Conversus StepStone Private Markets

Conversus StepStone Pivate Markets filed a registration statement for a new tender offer fund on July 2. In October 2019 it filed for a private offering but it didn’t appear to raise any money before switching to a public offering. This fund will invest dynamically across different private market asset classes including equity, debt and real assets. These will include both primary and secondary investments into funds, as well as direct investments. The fund is offering four share classes. The class A shares have no sales load, while the other share classes have sales loads ranging from 1.5%-3.5%. Management fee will be 1.4%, split between the adviser and the subadviser. StepStone is an asset manager focused on private markets with $62 billion in AUM as of the end of 2019. Conversus is their private wealth management platform.

For additional information on recently launched tender offer funds, see our tools and data section.