Where to Find Data on Unlisted Closed End Funds

Alternative investments are increasingly essential components of any prudent asset allocation plan. By allocating to alternative asset classes such as private equity, venture capital, real estate, hedge funds and private credit, investors can achieve better long term risk adjusted returns. Unlisted closed end funds, including both tender and interval funds, have proven to be an ideal investment vehicle to make alternative investments available to a wider audience. Yet the alternative investments industry has long suffered from a lack of transparency.

Fortunately, a comprehensive and reliable data source is now available. A Tender Offer Funds and Interval Funds provide a variety of free data sources on the unlisted closed end fund sector.

For too long, the unlisted closed end fund sector has suffered from a lack of comprehensive and reliable data sources. Interval Fund Tracker fills a critical industry need by improving transparency in this space

Interval Fund Tracker Expands Product Coverage

In this post we provide an overview of the different ways to access data and research on unlisted closed end funds.

Free Data Resources

A lot of unlisted closed end fund data is free and easily accessible. Here are some of the places you can access it.

List of Active Funds

It used to be difficult to find even a basic list of active interval funds and tender offer funds. Now, however, you can easily download a complete list covering the entire unlisted closed end fund market. There are currently over 70 interval funds, with a combined $38 billion in net assets, and 55 active tender offer funds with combined net assets of $31 billion. Note that for purposes of industry totals, all funds in a master-feeder structure count as a single fund.

Product Launch Pipeline

The unlisted closed end fund sector is growing fast. To keep track of the latest trends, monitor interval fund launches and tender offer fund launches. Interval Fund Tracker has an additional page with information on funds that have filed registration statements and are awaiting SEC approval.

Other Free Resources

For product specific research and commentary, Tender Offer Funds, and Interval Fund Tracker each have a blog.

Premium Unlisted Closed End Fund Data

Interval Fund Tracker’s Premium Plus Offering provide access to a wide range of additional resources. Product development teams at many of the industry’s top asset managers use Interval Fund Tracker for competitive intelligence, and product structuring ideas. RIA’s, broker-dealers, and sophisticated investors use the service to conduct due diligence, and research investment ideas.

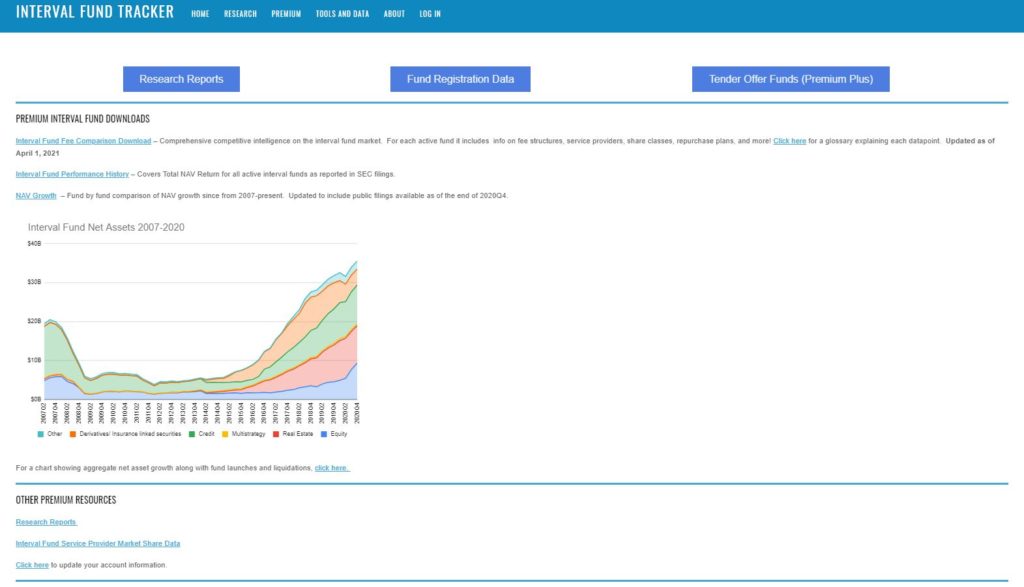

Here is a screenshot of the premium area:

Detailed Fund Structure Information

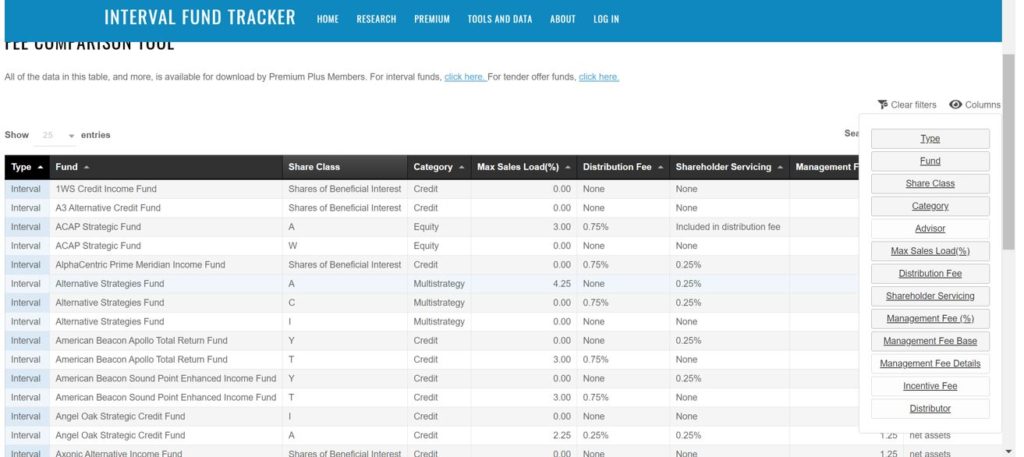

Comprehensive competitive intelligence on the unlisted closed end fund market is available for download in spreadsheet format. This covers every share class of every interval fund and tender offer fund that has been declared effective by the SEC and is still active. Info includes fee structures, service providers, share classes, repurchase plans, and more. Its set up to be easy to make into pivot tables in excel, or to run analysis using the Pandas package in Python(each share class is a separate row entry). Members get free updates to this for a year.

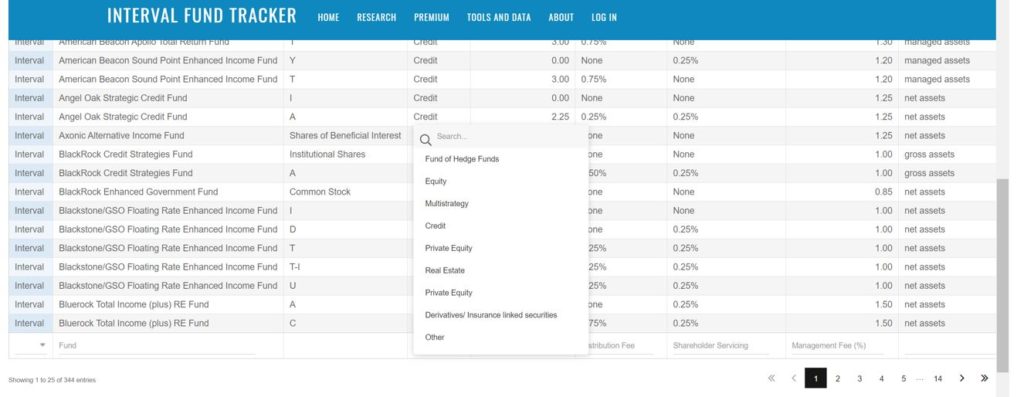

Unlisted Closed End Fund Fee Comparison Tool

The Fee Comparison Tool is an interactive table that allows you to easily filter by fund type and investment strategy, sort by fee levels, and search for Advisors and Distributors. All of the underlying data is available for download.

Searching by investment strategy:

Selecting which columns to include and exclude:

Interval Fund Performance History

Premium Plus members get access to a spreadsheet that covers Total NAV Return for all active interval funds as reported in SEC filings. This is updated each time a fund files an annual report.

AUM Growth

Users can also download a spreadsheet with a fund by fund comparison of NAV growth from calendar year 2007-present. Includes interval funds that liquidated as well those that are still active.

Tender Offer, Interval Fund, NT REIT, and BDC Registrations

To get a bigger picture view of the public alternative investment industry, its helpful to also follow REITs and BDCS. Users can download a spreadsheet that covers every new fund registration since 2016. This includes CIK#, and links to text files of registration statements.

About Ockham Data Group

Tender Offer Funds and Interval Fund Tracker are part of a new network of sites that Ockham Data Group launched in order to increase transparency in the alternative investments industry. Click here to learn more about Ockham Data Group.