Spotlight on Interval and Tender Offer Funds

Foreside recently released a new whitepaper: Product Spotlight: Interval and Tender Offer Funds. It is a valuable resource for any investment professional working with or considering launching an unlisted closed end fund. The paper integrates different perspectives on launching and running a fund including product design, portfolio management, regulatory, legal, and distribution. The paper covers the history of interval and tender offer funds, and provides an education on the similarities and differences between the structures. Most importantly, it provides extensive details on the product launch and distribution processes.

In this post, we highlight just a few of the key takeaways for asset managers. Check out the full whitepaper to get a more detailed understanding.

Understanding Fund Structure

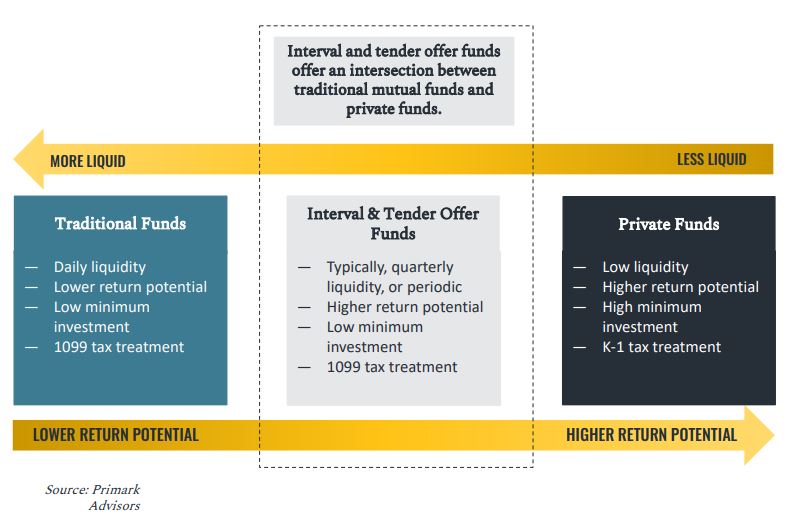

The paper includes a helpful diagram explaining how interval and tender offer funds fit between traditional mutual funds and private funds. Notably, there are tradeoffs between maximizing return potential, and maximizing liquidity. Unlisted closed end funds provide a compromise between these two competing needs, while also including the transparency and investor protection benefits of 1940 Act Funds.

Asset Manager’s Viewpoint

The paper cites several reasons that interval funds and tender offer funds are attractive to asset managers.

- Creating a retail product allows access to a much larger pool of investors. For many alternative asset managers, the mass affluent or retail market is completely untapped.

With previous focus on institutional clients and accredited investors, the vast number of potential investors is enticing.

- Many alternative asset managers are interested in reaching the retail market, but find the daily outflows associated with open-end mutual funds don’t work with their more long term focused strategy. Daily outflows also make it difficult for an asset manager to manage its overall business operations. Fortunately, closed end funds also have a lot of flexibility around liquidity. They can determine the liquidity offered to investors, including fixed quarterly, semi annual, or annual intervals in an interval fund, or discretionary, as in a tender offer fund.

- The reduced outflows allow asset managers to invest in less liquid, longer term assets. This avoids the problems faced by mutual funds that are forced to sell out of illiquid holdings at steep discount at hte worst possible time.

On the other hand, there are a couple challenges that asset managers that are used running private placements and marketing only to institutional investors:

- A new investor base introduces a learning curve. You need to take time to understand the nuances of retail and broad based advisory distribution.

- There is some risk of platform cannibalization, especially if institutional investors view the new closed end product as offering the same strategy in a lower cost wrapper.

Interval and tender offer funds are an important part of a major shift occurring in the asset management industry. Alternative investments are becoming an important part of more investor’s portfolios. Although there is more opportunity than ever before, there is also more competition. As Foreside notes in the paper:

Financial firms must innovate or risk becoming obsolete.

Getting the right product structure for the right strategy is an important part of financial innovation. You can access the full Foreside whitepaper here.

Looking for more information on interval and tender offer funds? Check out our premium subscription offerings.