3 Types of Management Fees

Interval Fund Tracker recently published a Premium Report: Fee Structures for Unlisted Closed End Funds. Asset managers considering launching an unlisted CEF can use this report to better understand the competitive landscape for tender offer funds and interval funds. Allocators and investors can use this report in their due diligence process to ensure that they are getting the best value for their money.

The full report is available for premium members. This post is an excerpt from that report.

Base management fees, also known as advisory fees, are ongoing fees paid out of a fund’s assets. The manager uses these fees to support operating costs and seek market opportunities. If a fund has a sub-advisor, then the advisor and sub-advisor will each take a portion of the base management fee. In most cases, the base management fee is the largest direct expense borne by shareholders. Moreover different share classes will have different distribution and servicing expenses, but they will almost always have identical management fees. The fund’s prospectus, and investment advisory agreement (available as an exhibit to the prospectus filed on EDGAR), will provide details on the structure of these fees. Broadly speaking, there are three different methods of calculating base management fees. (1)Net Assets (2) Total Assets (3) Committed Capital.

The following table summarizes the three different types of base management fees.

| Fee Calculation Method | Explanation | Advantages | Disadvantages |

| Net Asset(NAV) | Calculated based on net asset value of fund | Typically results in lowest overall fee; no incentive to use leverage | Management has less incentive to expand portfolio with leverage, even if justified by risk/reward tradeoff |

| Total Assets | Fee charged on all investment assets in the fund, including the impact from margin debt | Provides incentive for managers to devote resources to make full use of fund balance sheet | Can incentivize excessive leverage |

| Committed Capital | Includes capital committed to fund, whether invested or not | Management compensated for careful underwriting | Investors earn a negative return on idle funds while waiting for a capital call. |

Although there is some variation within these three categories, they are similar enough that we can make reasonable comparisons within them. To compare funds across different categories, an analyst needs to make adjustments by either estimating leverage, or estimating the speed at which committed capital will be invested.

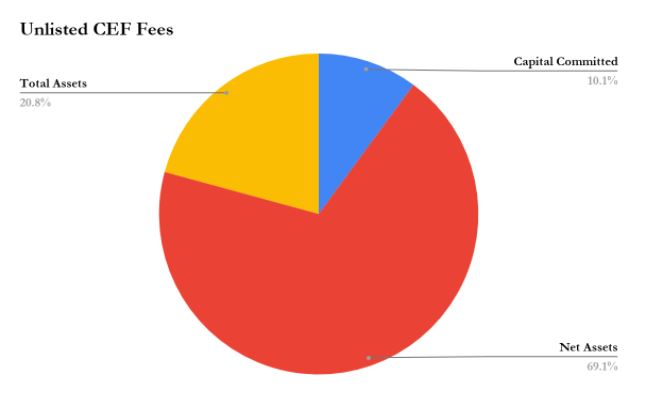

Around 70% of unlisted CEFs use net assets when calculating the base management fee. Total assets is the second most common method of calculating fees, accounting for around 20% of all unlisted CEFs. This method of calculating fees is more common for interval funds than tender offer funds. Approximately 10% of unlisted CEFs use capital committed in calculating base management fees. Note however, that all of these funds are tender offer funds. No currently active interval funds charge fees based on capital commitments.

Interested in accessing the full report? Click here to learn about Premium Membership Options