Neuberger Berman Crossroads Private Markets Platform

Neuberger Berman is an employee owned investment management firm with more than 2,000 investment professionals working in offices across 24 countries Founded in 1939, Neuberger Berman currently has more than $405 billion AUM. It serves institution investors as well as high net worth individual and retail investors. It offers financial planning, fiduciary services, and trust services for private clients. Many American retail investors are familiar with Neuberger Berman’s extensive platform of mutual funds and traded closed end funds. Less well known, however, is the fact that Neuberger Berman is also active in the alternative investments sector.

According to it’s website, Neuberger Berman currently has $80 billion in AUM in its alternative investments business. It has over 200 investment professionals in 9 countries are focused exclusively on alternative investments. Anthony D. Tutrone, the Global Head of Alternatives notes “Alternative investing is more central to the modern portfolio than ever.”

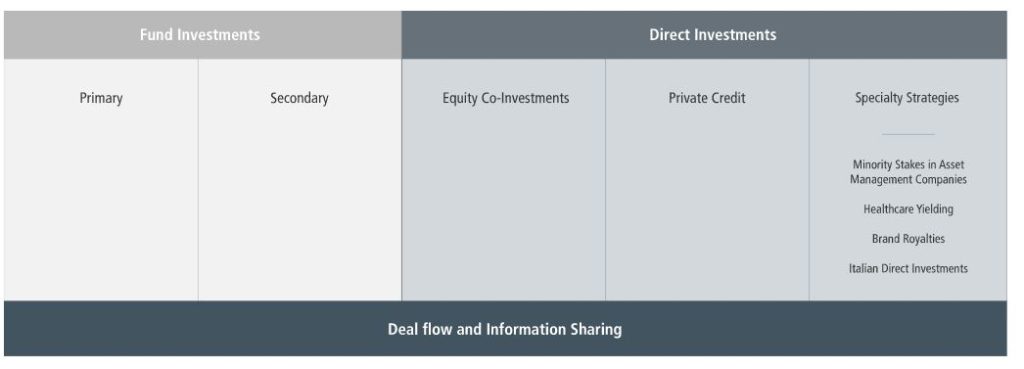

This diagram is useful for visualizing Neuberger Berman’s wide range of alternative business lines :

This article will focus on the unlisted closed end funds that Neuberger Berman offers.

NB Crossroads Private Markets Platform

Neuberger Berman offers unlisted closed end funds as part of its Crossroads Private Investment Portfolios platform. This platform of funds constructs diversified private equity portfolios across a wide range of asset classes, and strategies. Buyout, special situations, growth equity, and venture capital are included in asset class coverage. Strategies are diversified across primaries, secondaries, co-investments, and direct debt. Geographically, Neuberger Berman includes North America Europe, Asia, and Latin America in its Crossroads Platform. The ability to include this wide coverage is one advantage of having offices in more than 20 countries.

The success of the Crossroads platform makes Neuberger Berman one of the most prolific tender offer fund sponsors. This table summarizes the AUM for active tender offer funds on the Crossroads platform:

| Fund | Net Assets |

| NB Crossroads Private Markets Fund IV Holdings LLC | $330,946,487 |

| NB Crossroads Private Markets Fund V Holdings LP | $206,004,292 |

| NB Crossroads Private Markets Fund II(Master) LLC | $118,842,776 |

| NB Private Markets Fund III (Master) LLC | $95,272,755 |

| NB Crossroads Private Markets Fund VI Holdings LP | $65,877,179 |

Neuberger Berman is in the process of launching a seventh fund in the series, as we covered in a recent post.

Each of these NB Crossroads funds has multiple feeder funds with different fee levels and terms. The Crossroads tender offer funds also function more like a typical private equity fund in that investors commit capital to the fund, which then conducts capital calls upon finding investment opportunities. Management fees are charged based on capital committed. For more details on the structure and terms of the NB Crossroads funds, check out the tender offer funds comparison tool, available to Premium Subscribers.

Neuberger Berman has recently started launching a simplified version of these funds as well.

Private Markets Access

In January of this year, Neuberger Berman announced a plan to open up the crossroads platform to an even wider range of investors. According to its prospectus, Neuberger Crossroads Private Markets Access Fund will make secondary investment in private equity funds, and co-invest alongside top tier private equity fund sponsors. Neuberger Employees contributed $34 million to this new fund.

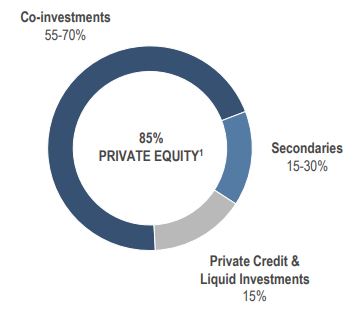

This graph summarizes the targeted investment portfolio for the Crossroads Private Markets Access Fund.

While typical PE funds are only available to qualified purchasers, and require up to $5 million in initial investment, the Private Markets Access Fund is available to accredited investors and requires only $50,000 in initial investment. Typical PE funds also have capital calls, which can be difficult to manage from a cash flow planning perspective. The Private Markets Access Fund, in contrast, requires just a single initial investment. This is how the new Private Markets Access Fund distinguishes itself from the rest of the Crossroads platform.

More Private Equity Tender Offer Funds

Using an unlisted closed end fund structure to invest in private equity has many advantages. For example, all unlisted closed end funds that invest in private equity have simple 1099 tax reporting. This is much easier for financial advisers and their clients to deal with than the complex K-1s typically used by private equity funds. Unlisted closed end funds also conduct perpetual capital raises with monthly subscriptions, allowing the fund to take advantage of opportunities across a long period of time, rather than all in one vintage year.

To learn more about Neuberger Berman’s unlisted closed end funds, as well as private equity funds please visit our Active Funds page.