Central Park Group: Closed End Fund Pioneer

Central Park group is an investment advisory firm that offers private equity, hedge fund, real estate and funds of funds investments for institutions and private clients. Central Park Group had approximately $3 billion in discretionary assets under management as of December 31, 2020, according to their latest form ADV.

Launched in 2006, Central Park Group is one of the most successful sponsors in the unlisted closed end fund space. This article will focus on the private equity and hedge fund products that Central Park Group sponsors.

Central Park Group Investment Strategy

A key part of Central Park Group’s strategy has been based on extensive manager due diligence and building relationships with top tier managers over the years. This increases the likelihood that their private equity and hedge fund of funds strategies are heavily allocated to top tier managers.

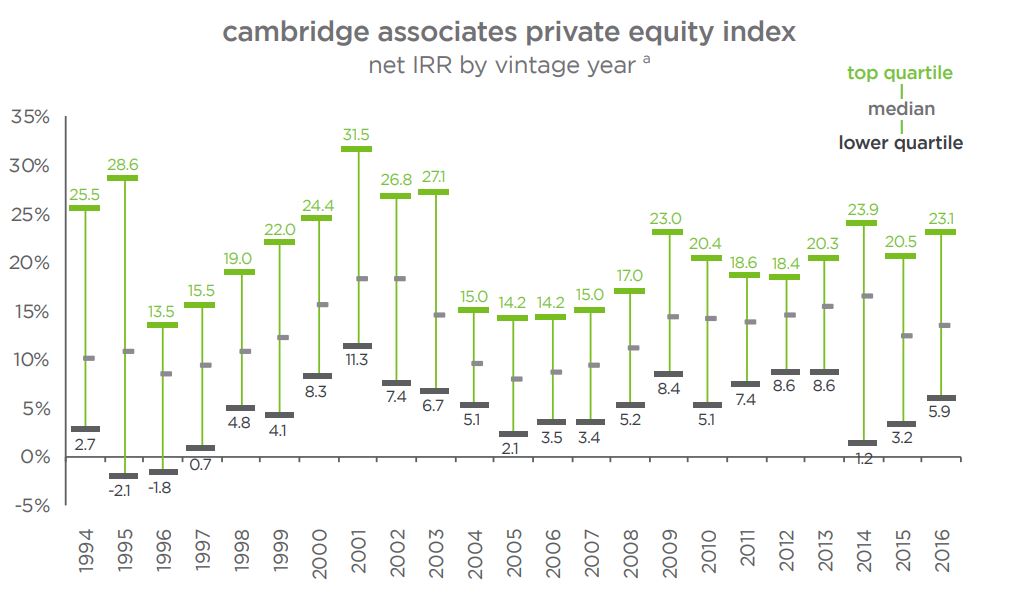

Avoiding low quality managers can be key to long term success in private equity, as the following chart demonstrates:

After identifying timely and opportunistic investment themes, Central Park Group drills down to find individual managers and funds. For private equity and real estate funds they focus on managers with proprietary deal flow, operational experience, and creative financial structuring. For hedge funds , they focus on understanding the unique competitive advantage of each manager, and avoid “black box” strategies.

Central Park Group has several “Access Funds” which aggregate capital from many investors to invest in managers that typically have high minimum investment requirements(in some cases up to $25 million). These “Access Funds” enable high net worth individuals and smaller institutions to purchase. Central Park Group has Access Funds focusing on particular managers, as well as particular strategies and vintage years. The majority of Central Park’s AUM is in registered funds that provide access to private equity and hedge funds.

Central Park Group Funds

Excluding feeder funds to avoid double counting, Central Park Group currently has seven tender offer funds with approximately $2 billion in net assets.

This chart summarizes the active funds in the market that Central Park Group sponsors:

| Fund | Category | Net Assets |

| CPG Carlyle Commitments Master Fund | Private Equity | $981,771,217 |

| CPG Focused Access Fund, LLC | Fund of Hedge Funds | $509,620,320 |

| CPG 2017 Vintage Access Fund, LLC | Private Equity | $129,572,874 |

| CPG Vintage Access Fund II, LLC | Private Equity | $97,986,293 |

| CPG Vintage Access Fund III, LLC | Private Equity | $58,489,923 |

| CPG Cooper Square International Equity, LLC | Equity | $32,160,038 |

| CPG Vintage Access Fund IV, LLC | Private Equity | $0 |

The CPG Carlyle Commitments Fund is the second largest private equity tender offer fund, with nearly $1 billion in total net assets. CPG also has four “Vintage Access” funds in private equity. The CPG Focused Access Fund is a hedge fund solution with over $500 million in AUM. Recently, Central Park also launched CPG Cooper Square International Equity, a public equity strategy focused on global markets. Select Equity Group will serve as the sub-advisor for the public equity allocation.

Notably most of these funds are exclusively offered through private placements, but because they are registered under the 1940 act, they must file extensive information with the SEC. This provides an added layer of transparency that makes the due diligence process easier.

Where to Find More Information

To learn more about Central Park Group’s unlisted closed end funds, as well as other Private Equity and Hedge Fund Solutions please visit our Active Funds Page. For more details on the structure and terms of the Central Park Group Funds, check out the comparison tool available to Premium Subscribers.