Private Equity Tender Offer Funds

Based on total net assets, private equity is the second most popular category of tender offer funds. Private equity tender offer funds have over $10 billion in net assets, accounting for 31% of total tender offer fund AUM, as of March 2021.

In this post we summarize the benefits of private equity , and look at the largest sponsors offering exposure via unlisted closed end funds.

Why Private Equity?

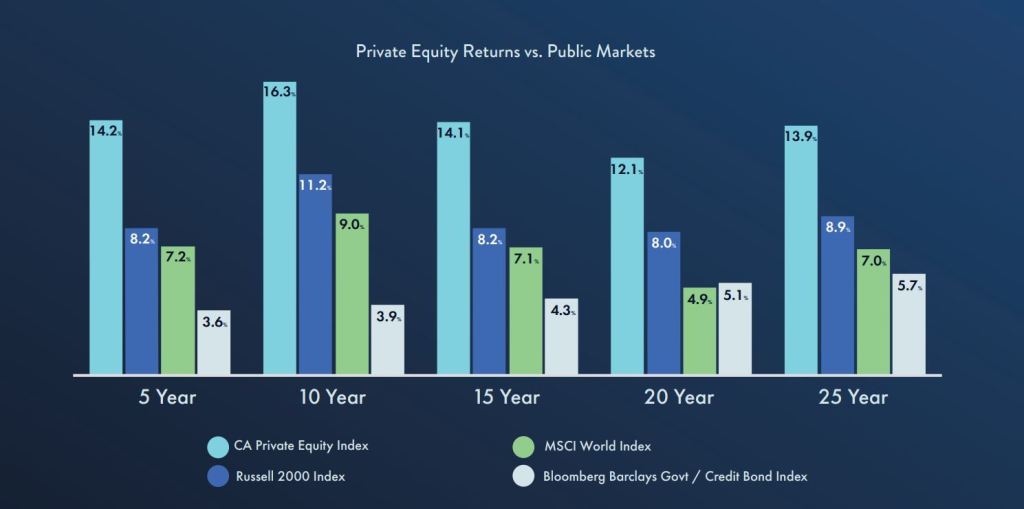

Adding private equity funds to a diversified portfolio can lead to higher returns and lower volatility over the long term.

The following chart, from Primark Capital, shows the benefits of investing in Private Equity

The importance of private equity has increased as the universe of listed companies has shrunk. More companies are staying private longer, meaning investors that only invest in public markets are missing out on an important source of growth.

Typical private equity funds are only available to qualified purchasers, and high investment minimums- sometimes greater than $5 million. However, many private equity tender offer funds are available to all accredited investors and have investment minimums as low as $50,000. Some interval funds have even lower investment minimums. Additionally, private equity funds typically require a capital commitment, then call capital as they find investments. This can make cash flow management for individual investors. Some private equity tender offer funds follow this convention, but others provide access with a single investment. Finally, private equity funds are usually structured as private partnerships, and require complex K-1 tax forms. In contrast, most private equity tender offer funds have simple 1099 tax filings.

With the right manager, private equity tender offer funds can be a solution for a lot of investors portfolios. In the next section we’ll look at the best options available in the market.

Largest Private Equity Tender Offer Funds

There are 23 active private equity tender offer funds.

Partners Group Private Equity (Master Fund) is the largest private equity tender offer fund, with $.6.7 billion in net assets. This fund makes primary and secondary investments into private equity funds, along with direct investments into operating companies. In some cases it will coinvest in operating companies alongside private equity sponsors.

Central Park Group is another major sponsor of private equity tender offer funds. The CPG Carlyle Commitments Fund is the second largest private equity tender offer fund, with nearly $1 billion in net assets. Central Park Group also sponsors funds that offer exposure to a specific private equity vintage year, such as the CPG 2017 Vintage Access Fund, which has $129 million in net assets.

Neuberger Berman offers tender offer funds through its CrossRoads private Investment Portfolios Platform. It has 6 funds currently in the market. Their largest fund is the NB Crossroads Private Markets Fund IV Holdings, which has $330 million in net assets.

This table shows the ten largest funds in this category, along with their net assets as of the most recent public filing:

| Fund Name | Net Assets |

| Partners Group Private Equity (Master Fund), LLC | $6,771,124,543 |

| CPG Carlyle Commitments Master Fund | $981,771,217 |

| Altegris KKR Commitments Master Fund | $429,668,735 |

| NB Crossroads Private Markets Fund IV Holdings LLC | $330,946,487 |

| AMG Pantheon Master Fund, LLC | $297,022,688 |

| Pomona Investment Fund | $265,899,244 |

| NB Crossroads Private Markets Fund V Holdings | $206,004,292 |

| CPG 2017 Vintage Access Fund, LLC | $129,572,874 |

| NB Private Markets Fund II (Master) LLC | $118,842,776 |

| FlowStone Opportunity Fund | $103,672,219 |

Where To Find More Info

For more a complete list of true private equity solutions in unlisted closed end fund vehicles, check out the active funds page. Additional information, including expense ratios and performance history is available for premium members.